The short answer is a resounding yes! The accounting profession, once synonymous with the traditional office environment, is undergoing a dramatic transformation, embracing remote and hybrid work models at an unprecedented rate. This comprehensive guide delves into the current state of remote accounting, exploring its benefits, challenges, and future trajectory. We'll examine the data driving this shift, the essential tools and skills needed, and the exciting opportunities available to accountants seeking flexible work arrangements.

The Rise of Remote Accounting

The COVID-19 pandemic acted as a catalyst, forcing a rapid shift to remote work across numerous industries, including accounting. While some firms had already begun exploring remote options, the pandemic accelerated the adoption of flexible work arrangements. Data from Robert Half, for example, showed over 600 remote accounting jobs listed in May 2023 alone. This reflects a broader trend: 80% of firms now allow regular or fluid remote work, a near doubling from previous years (2022 data). This significant increase wasn't entirely unexpected. Even before the pandemic, a survey indicated that only 29% of financial services firms had at least 60% of their workforce working from home weekly. The pandemic dramatically changed this landscape, with 43% of tax professionals working remotely most or all of the time at the peak of the crisis.

This shift wasn't just about survival; it also impacted employee well-being. While 23% of remote tax professionals reported a negative impact on their well-being, a significant 48% reported a positive effect, highlighting the potential benefits of flexible work. This increase in remote work is also reflected in job-seeking trends. A staggering 41% of accounting professionals were actively searching for new jobs in the first half of 2023, with 63% preferring hybrid roles and 47% seeking fully remote positions. This demand is further underscored by the fact that 69% of financial services firms anticipate 60% of their workforce continuing to work from home weekly.

Image Credit: Udemy website

How to Successfully Work from Home as an Accountant?

Successfully working from home as an accountant requires careful planning and the right tools. Let's explore the key elements for a productive and secure remote setup.

Setting Up a Productive Home Office

Creating a dedicated workspace is crucial. This isn't just about having a desk; it's about establishing a clear separation between work and personal life. A well-equipped home office should include:

- Ergonomic furniture: A comfortable chair, adjustable desk, and proper lighting can prevent strain and promote productivity.

- High-speed internet: Reliable connectivity is paramount for seamless access to cloud-based software and client communication.

- Dual monitors: Many accountants find that dual monitors significantly enhance their workflow, especially when working with multiple applications and large datasets.

- High-quality printer/scanner: A multifunction printer-scanner is essential for handling documents and receipts efficiently. A model like the Canon PIXMA TR8620 is a popular choice among remote accountants. Its cost is approximately $179.99.

- Secure and reliable laptop/desktop: A robust computer with sufficient RAM (at least 8GB) and processing power is crucial to handle demanding accounting software and large datasets. This could cost between $500-$1500 depending on the specification.

Maintaining Information Security While Working Remotely

Data security is paramount in accounting. Protecting sensitive client information requires a multi-layered approach:

- Secure cloud-based accounting software: Utilize reputable cloud-based software like QuickBooks Online or Xero, which offer robust security features, including encryption and access controls.

- Secure file transfer solutions: Employ secure methods for transferring sensitive documents, avoiding methods like email unless it has end-to-end encryption.

- Strong passwords and multi-factor authentication: Implement strong, unique passwords for all accounts and utilize multi-factor authentication whenever possible.

- Regular software updates: Ensure all software, including operating systems and antivirus programs, are up-to-date to patch security vulnerabilities.

- Secure workstations: Employ firm-assigned equipment to ensure data security and compliance.

Image Credit: Heffernan Insurance Brokers website

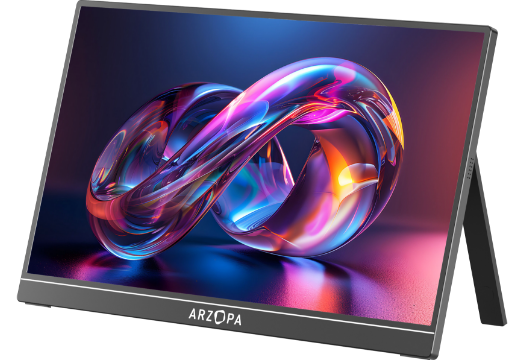

Do I need a Portable Screen for my Home Office Accountant?

As an accountant who works from home, whether you need a portable monitor mainly depends on your work habits and specific requirements. Here are some factors to consider:

Situations Where a Portable Monitor is Needed

Situations Where a Portable Monitor May Not Be Needed

Relatively Simple Work Content: If your daily work mainly involves handling simple documents and spreadsheets and you don't need to open multiple windows simultaneously for comparison and operation, the existing screen of your laptop may already meet your needs.

As a home-based accountant, the Arzopa A1 Travel Monitor is your go-to tool.

It shines in multitasking. Juggle accounts, reports, emails and team chats all at once. One screen for focused input, the other for info tracking, no more tiresome window-switching, boosting efficiency. Lightweight and portable, it’s super convenient.

Change work spots freely, be it by the window or on the sofa. Just hook it up to your laptop and work unfettered. With high-definition and precision, numbers and charts come alive clearly. Spot financial trends, compare income-expenditure details in a blink, ensuring error-free accounting.

The practical eye protection tech lets you stare long without worry. It filters blue light and adjusts brightness smartly, keeping eyes comfy and focus sharp.

Opt for it to make home accounting a breeze, precise and efficient.

The Pros and Cons of Remote Work for Accountants

While the shift to remote work is largely positive, it's important to acknowledge both the advantages and disadvantages.

Advantages of Remote Accounting

Flexibility and improved work-life balance: Remote work offers unparalleled flexibility, allowing accountants to manage their schedules to better fit their personal lives. Many surveys demonstrate the preference for this work style—79% of employees in some surveys prefer a hybrid model. The elimination of commuting time alone can significantly boost productivity. Studies show 6 out of 10 workers report higher productivity while working from home. This also leads to a happier staff and better work-life balance.

Cost savings for both firms and employees: The average cost of maintaining an in-office employee is around $18,000 per year. Remote work significantly reduces overhead costs for firms, while employees save on commuting expenses and potentially office attire.

Expanded talent pool: Firms can access a wider range of talent, regardless of geographical location.

Increased productivity for many: Many accountants find that they are more productive working from home, free from office distractions.

Disadvantages of Remote Accounting

Isolation and loneliness: The lack of face-to-face interaction can lead to feelings of isolation and disconnection.

Blurred work-life boundaries: The lines between work and personal life can easily blur, leading to longer work hours and burnout.

Communication challenges: Effective communication is crucial in accounting, and remote work can present challenges in this area.

Technological challenges: Reliable internet access and proficiency with various software and tools are essential, and glitches can cause disruptions. This is where cybersecurity and the safe use of secure accounting software, such as QuickBooks or Xero, becomes extremely critical. Also, the accounting software’s integration with various platforms (e.g., PayPal and Shopify) plays a significant role.

Compliance concerns: Adhering to various regulations and maintaining data security are more critical than ever before in a remote setting.

How to Get Remote Accounting Jobs?

The demand for remote accounting professionals is high and growing. Several roles are particularly well-suited for remote work.

In-Demand Remote Accounting Roles

- Certified Public Accountant (CPA): CPAs handle complex financial matters, requiring expertise in accounting principles, tax regulations, financial analysis, and client management.

- Management Accountant: These professionals provide strategic financial guidance, utilizing skills in financial planning, budgeting, cost management, and business strategy development. Often they are certified as a CMA.

- Tax Accountant: Tax accountants prepare tax returns, ensuring compliance with tax regulations. Expertise in tax law and financial record-keeping is crucial. CPAs or EAs are preferable.

- Forensic Accountant: Forensic accountants investigate financial discrepancies and fraud; analytical skills, attention to detail, and knowledge of legal regulations are essential. A CFE certification is valuable.

-

Bookkeeper: Bookkeepers maintain financial records, requiring proficiency in accounting software like QuickBooks and a strong eye for detail.

Finding and Securing a Remote Accounting Job

- Online job boards: Utilize platforms like Indeed, LinkedIn, and specialized accounting job boards.

- Networking: Leverage your network to identify potential remote opportunities.

- Company websites: Check the career pages of companies known for offering remote positions.

- Freelance platforms: Explore platforms like Upwork and Fiverr for freelance accounting opportunities.

The Impact of Remote Work on the Accounting Industry

Remote work is fundamentally reshaping the accounting industry. This shift has resulted in:

- Increased competition: The accessibility of remote work has led to increased competition for accounting jobs, potentially requiring higher skill sets and better qualifications.

- New skill requirements: Accountants are needed with expertise in cloud-based software, digital security, and remote communication strategies.

- Changes in firm structures: Many firms are restructuring, decreasing office space and adapting to the demands of a remote workforce.

- Changes in client expectations: Clients are increasingly expecting remote access to their financial information and greater flexibility in communication.

Conclusion

The transition to remote work in the accounting industry is not just a trend; it’s a fundamental shift reshaping the profession. While challenges exist, thoughtful planning, strategic technology adoption, and a focus on effective communication can help accountants thrive in this new environment. The future of accounting is undoubtedly intertwined with advancements in technology and evolving work preferences. By embracing these changes, accountants can unlock new opportunities for growth, increased flexibility, and a more fulfilling career path. The data is clear: remote accounting is here to stay, and its impact on the industry will only continue to evolve.

If you have any further questions or would like to share your experiences about it, please leave a comment below. Don't forget to share this article with your friends and colleagues who may benefit from the information. Happy browsing!

FAQ

How can accountants ensure data security when working remotely?

Ensuring data security in a remote accounting environment requires a multi-pronged approach. First and foremost is the utilization of secure cloud-based accounting software such as QuickBooks Online or Xero. These platforms offer robust security measures, including data encryption both in transit and at rest, and multi-factor authentication to restrict access. Beyond the software itself, robust cybersecurity practices are vital. This includes the use of strong, unique passwords for all accounts and the implementation of multi-factor authentication whenever possible.

Regularly updating all software, including operating systems and antivirus programs, is crucial in patching security vulnerabilities. Secure file transfer solutions should be employed; avoiding less secure methods such as email unless it uses end-to-end encryption. Training employees on best cybersecurity practices must be continuously done, and implementing strict access controls to sensitive data with regular usage monitoring significantly improves data security. Lastly, implementing a comprehensive cybersecurity incident response plan is essential for dealing promptly and effectively with potential breaches. A firm understanding of data privacy regulations like GDPR and CCPA is also crucial, ensuring compliance and protecting client data.

What are the best practices for maintaining work-life balance while working remotely as an accountant?

Maintaining a healthy work-life balance while working remotely as an accountant requires intentional effort and the establishment of clear boundaries. Firstly, it's crucial to designate a specific workspace solely for work, physically separating it from areas associated with relaxation and personal activities. Next, establishing a defined work schedule with consistent start and end times is vital, including breaks within the schedule to avoid burnout. Adhering to these times is key; discouraging after-hours work as much as possible. Leveraging time management techniques, such as the Pomodoro Technique, helps enhance focus and productivity during work hours.

Regularly scheduling 'offline' times for disconnection and recharging is essential, allowing for activities that foster relaxation and well-being outside of work. Encouraging social interactions, whether through virtual team building events or personal activities, helps counter feelings of isolation often associated with remote working. Communicating clearly with family members about work hours, enforcing a distinction between family time and work time, will ensure fewer disruptions. Regularly reviewing and adjusting the schedule and techniques used to ensure their efficacy is important.

How can remote accounting firms compete with traditional firms?

Remote accounting firms can compete effectively with traditional firms by leveraging their unique advantages. This includes emphasizing cost-effectiveness, offering flexible service options that better match client needs, and showcasing their access to a wider and more diverse talent pool. By adopting advanced technology and automation, remote firms can increase efficiency and reduce operational costs. This allows them to offer highly competitive pricing while maintaining quality service. Cloud-based solutions enable greater collaboration and transparency, strengthening client relationships by facilitating easy access to their financial information.

Moreover, skilled marketing strategies that highlight the benefits of remote work—like flexibility and tailored service—can attract clients seeking personalized and efficient accounting solutions. Developing strong online presence and networking actively within their professional communities helps raise company profile and credibility. They can also emphasize their commitment to cybersecurity and data privacy; highlighting their robust security measures to reassure clients about the safety of their financial data.